Stimulus Set Design

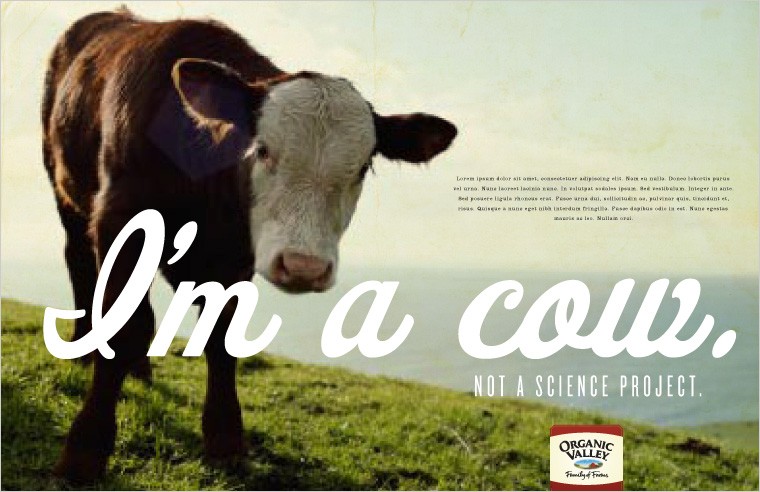

Organic Valley advertisement

This is the first post in a series demonstrating the process via which Semiovox’s interpretative inquiry produces insights and inspiration — richer and deeper than what consumer research alone can provide — regarding a product category’s or cultural territory’s unspoken meanings.

Our category: Real Food, which is to say food brands that communicate realness through packaging cues, advertising, social media, brand website, in-store marketing, and so forth.

The first, critically important stage of a Semiovox audit involves designing the stimulus set. In order to ensure that we’re painting an accurate, persuasive portrait of the Real Food space, we’ll want to include leading Real Food brands — brands, that is to say, which enjoy significant market share and/or consumer mindshare — in our market.

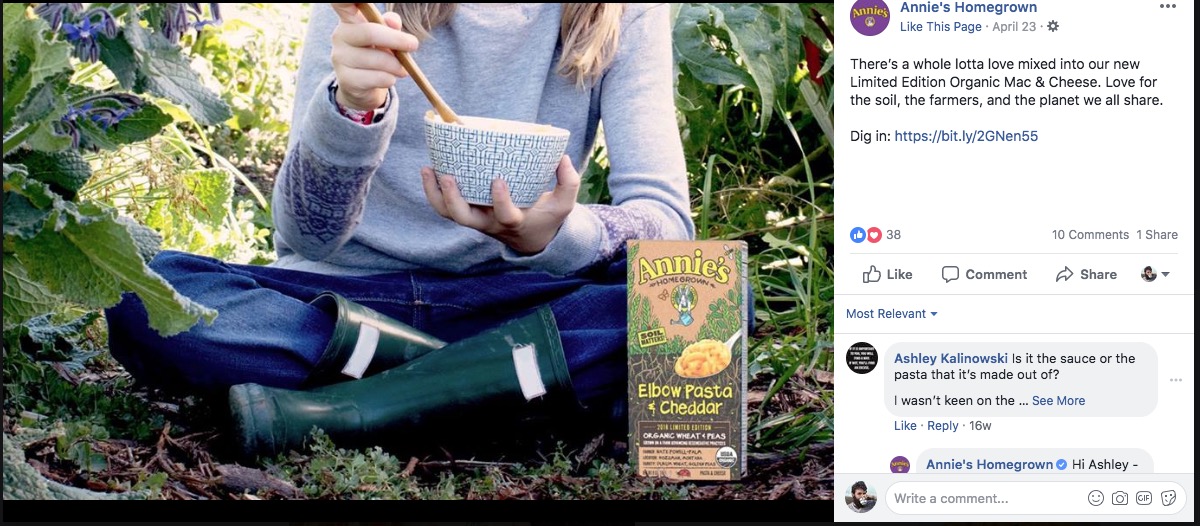

Annie’s social media

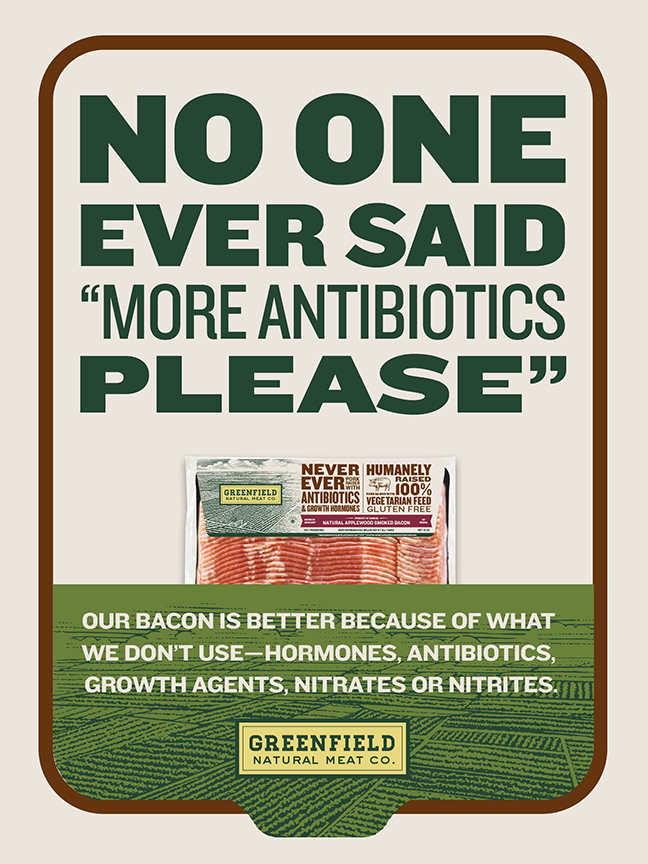

Greenfield print ad

Bell & Evans pack

Horizon website

Although our projects are often global in scope, in this case we’ll restrict our focus to the United States. There are various ways to ascertain which Real Food brands control the most market share and mindshare in the US: market research on the packaged food industry (indicating, e.g., total market sizes, market share and brand share data, distribution and industry trends, etc.); consumer research; even a glance at top-selling brands at appropriate online retailers, or a stroll through a supermarket, is useful when designing a stimulus set.

When conducting an audit on behalf of a client, although we suggest an initial list of leading competitive brands, stimuli design is a collaborative process. We’d also ask the client to suggest stimuli, then work together to reduce the number of brands to a reasonable total. We’ll typically build a 1st Touchpoint debrief into our process, because we’ve learned that when clients see our initial analysis they’ll suddenly recall particular brands, and particular brand packaging and marketing campaigns, that didn’t come to mind when we were first designing the stimulus set. So after the 1st Touchpoint, we’ll add a few additional brands to our stimulus set.

Hip Chick social media

Vermont packaging

Oatly social media

Exo social media

Because we want to not only inform but inspire our clients — by stretching their thinking, helping them catch a glimpse of best practices not only in their own category, but in parallel and stretch categories too — we’d also want to include challenger brands. Real Food brands, that is, which may not be market or mindshare leaders, but which are challenging and disrupting the Real Food space via unconventional packaging, advertising, social media, and so forth.

So let’s assume that our Real Food stimulus set includes (but is not restricted to) communications from the following brands:

- Annie’s

- Bell & Evans

- Beyond Meat

- Chobani

- Clif

- Dietz & Watson

- Epic

- Evol

- Exo

- Forager

- Greenfield

- Halo Top

- Hip Chick Farms

- Horizon

- Hormel Natural Choice

- Impossible Foods

- Just…

- Justin’s

- Kashi

- Kind

- Niman Ranch

- Once Upon a Farm

- Organic Valley

- Oscar Mayer Naturals

- Perdue Simply Smart

- Rx

- Siggi’s

- Stonyfield

- Tyson Naturals

- Vermont Smoke & Cure

- Wellshire

Stimuli design is critically important, so let’s proceed with caution. Does our Real Food stimulus set include a fair share of mainstream, market- and mindshare-leading brands, as well as interesting Real Food challenger brands? Yes! (We won’t share every detail of the process, in this post, so you’ll just have to take our word for it.) Within “food” are we covering, e.g., meat, eggs, yogurt, cereal, and prepared meals? Yes! Does our Real Food stimulus set also include a number of interesting challenger brands who are disrupting the Real Food space via, e.g., innovative packaging design, marketing, and higher-order benefits? Yes! In addition to packaged food brands, have we included Real Food retailers, and beverage (including milk, milk substitutes, and iced tea) and snack/confection brands communicating realness? Yes!

OK, then, we’re off to a good start — let’s proceed.

Next Step: STIMULI RESEARCH

A note on Semiovox’s unique approach: Each of our audits surfaces eight paradigms, paired into four binary codes. (A semiotic code is always a binary opposition — two paradigms, each of which is defined in and through its opposition to the other.) Each paradigm is composed of two contrasting thematic complexes; each of these complexes is dimensionalized by source codes (aka signs); and each source code is composed of a norm and a unique visual/verbal form which brings that norm to life. Our methodology involves first identifying source codes from within the stimuli we’ve researched, then — through our meta-analysis of these signs — building a theory about the matrix of meaning which, operating below the level of daily consciousness, enables members of a culture to intuitively “make sense” of everything from brand communications to pop culture, social media, and retail spaces.